Give Bitcoin, Ethereum and other Crypto Assets

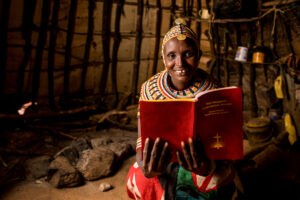

Getting God’s Word into the heart language of those still waiting for it is as innovative as your investment portfolio. Create kingdom impact by gifting crypto directly to fuel Seed Company’s global efforts.

Frequently Asked Questions About

Donating

Cryptocurrency

Is the process of giving cryptocurrency safe and secure?

Our third-party platform, Engiven, provides the highest level of safety by using blockchain security. Relying on the networks of thousands of computers to verify transactions, Engiven drastically minimizes the risk of cyber-attacks or fraud.

What is cryptocurrency?

Cryptocurrency is also known as virtual currency or crypto. It is virtual or digital money in the form of tokens or coins. Designed as an alternative to sovereign fiat currency, cryptocurrencies can also be traded, bought and sold on exchanges with U.S. dollars and other traditional currencies.

Records of cryptocurrency transactions are kept in public, digital ledgers called blockchains. In essence, a blockchain is a group of people, called miners, who lend their computing power to verify other users’ transactions so that the same token or coin isn’t spent twice.

Most people think of Bitcoin when they hear the word Crypto, but thousands of other cryptocurrencies, such as Ethereum (ETH), Litecoin (LTC) and Dogecoin (DOGE) exist.

Is a cryptocurrency donation tax-deductible?

Yes. Your tax deduction will be equal to the fair market value of the donated cryptocurrency as determined by a qualified appraisal.

Since nonprofits are exempt from paying capital gains tax on the sale of assets, the full value of your cryptocurrency donation, along with your tax deduction, stays intact.

How should an investor value their cryptocurrency donations for federal income tax purposes?

For U.S. tax purposes, virtual currency transactions must be reported by the taxpayer, in U.S. dollars, at the fair market value on the date of the donation. If a virtual currency is listed on an exchange and the exchange rate is established by market supply and demand, the fair market value of the virtual currency is determined by converting the virtual currency into U.S. dollars at the exchange rate in a reasonable manner that is consistently applied.

Engiven provides all the necessary tax documents for you to claim your deduction on your tax returns. Make sure to keep these documents for your records.

What is the difference between various cryptocurrencies?

Bitcoin, launched in 2009, is the original cryptocurrency and the most widely used. It was designed with a finite supply of tokens/coins. Bitcoin Cash (BCH) is a new version of Bitcoin that features a faster verification process.

Several thousand digital currencies other than Bitcoin now exist. Collectively, they are called altcoin (alternatives to Bitcoin), and most have been developed to improve upon Bitcoin in some way.

Some altcoins use a different process to produce and validate transactions. Others might offer new features or an advantage like lower price volatility. Gemini Dollar (GUSD) is an example of a stablecoin, a class of cryptocurrency that attempts to offer price stability by pegging its value to the US dollar.

Many altcoins have little to no following or trading volume, but some, like Dogecoin (DOGE) and Ethereum (ETH), are immensely popular.

What is the advantage of donating cryptocurrency?

Donating cryptocurrency to nonprofits has several advantages. It’s a convenient and secure way to give to your favorite causes and help change lives. To donate cryptocurrency to Seed Company, follow the steps in the form above and your donation will be complete in just a few minutes.

As with any other donation type, donating crypto qualifies you for the tax benefits associated with a charitable contribution.

Donating cryptocurrency is also one of the most tax-efficient ways to support a nonprofit. Since the IRS considers cryptocurrency to be a noncash asset, a direct charitable donation is a non-taxable event. In other words, you avoid paying the capital gains tax you would incur if you sold your cryptocurrency for more than you bought it.

Avoiding the capital gains tax through a direct donation also means that your gift is maximized. With Seed Company, that translates into more Scripture for the unreached!

What is Engiven?

The Engiven platform is the software Seed Company uses to process cryptocurrency donations. Those donations are exchanged for US dollars.

Learn more about Engiven.

Is it legal for nonprofits to accept cryptocurrency?

Yes, it is lawful. In March 2014, the IRS ruled that cryptocurrency is treated as property (or a non-cash asset) for tax purposes (IRS Notice 2014-21).

What will Seed Company do with my cryptocurrency donation?

Engiven will immediately exchange your donated cryptocurrency for US Dollars at the current exchange rate. Then the proceeds will be deposited into Seed Company’s bank account. Because Seed Company does not directly trade in cryptocurrency, the organization will not hold any donated cryptocurrency for a potential rise in value.

Seed Company is a 501(c)(3) organization. All contributions are tax deductible, non-refundable, and will be applied where most needed within Seed Company’s program activities. Our Federal ID is 33-0838929.

© 2025 Seed Company